Mutual funds vs. ETFs sets the stage for this epic showdown, giving you a sneak peek into a story packed with all the deets and vibes you need to know.

Get ready for the lowdown on these investment options that’ll have you feeling like a finance guru in no time.

Overview of Mutual Funds and ETFs

Mutual funds and ETFs are popular investment options that allow individuals to invest in a diversified portfolio without having to pick individual stocks. Here’s a breakdown of each:

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are actively managed by professional fund managers who make investment decisions on behalf of the investors. Key features of mutual funds include:

- Professional management

- Diversification

- Liquidity

- Higher fees compared to ETFs

ETFs

ETFs, or exchange-traded funds, are similar to mutual funds in that they also offer diversification by investing in a basket of securities. However, ETFs are traded on stock exchanges like individual stocks, and their prices fluctuate throughout the trading day. Unlike mutual funds, ETFs are passively managed and aim to track a specific index. Key features of ETFs include:

- Low expense ratios

- Trading flexibility

- Tax efficiency

- Ability to buy and sell throughout the trading day

Structure and Management

When it comes to the structure and management of mutual funds and ETFs, there are some key differences to consider.

Structure of Mutual Funds

Mutual funds are typically owned by individual investors who purchase shares in the fund. These funds are managed by professional fund managers who make investment decisions on behalf of the investors. The fund manager’s goal is to grow the fund’s assets and achieve the fund’s investment objectives.

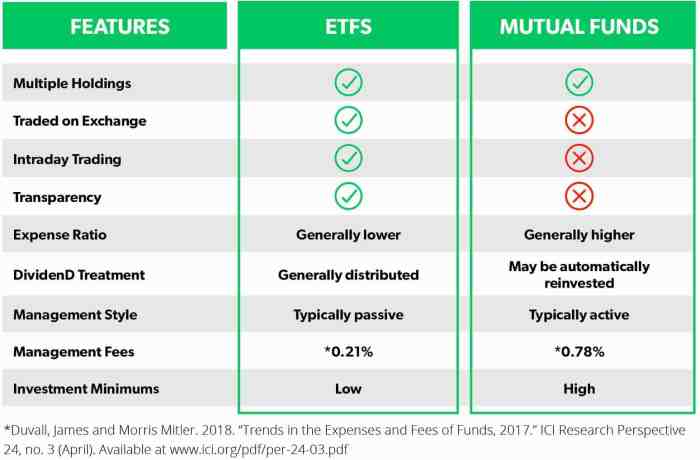

Comparison of Management Styles

In terms of management styles, mutual funds are actively managed, meaning that the fund manager actively buys and sells securities in an attempt to outperform the market. On the other hand, ETFs are passively managed, meaning that they typically track a specific index and aim to replicate its performance. This difference in management styles can impact factors such as fees, tax efficiency, and overall performance.

Role of Fund Managers

Fund managers play a crucial role in both mutual funds and ETFs. In mutual funds, fund managers are responsible for selecting individual investments, monitoring the fund’s performance, and adjusting the fund’s holdings as needed. In ETFs, fund managers play a more passive role, focusing on tracking the performance of the underlying index and ensuring that the ETF’s holdings align with the index.

Cost Comparison

Investing in mutual funds and ETFs involves different costs that investors should consider before making a decision. Let’s break down the cost differences between the two options.

Expense Ratios

Expense ratios are annual fees charged by mutual funds and ETFs to cover operating expenses. Mutual funds typically have higher expense ratios compared to ETFs. On average, mutual funds charge around 1-2% of assets under management, while ETFs usually have expense ratios below 0.5%. This difference can significantly impact the overall returns on investment over time.

Trading Costs

Trading costs refer to the fees associated with buying and selling shares of mutual funds and ETFs. Mutual funds are traded once a day after the market closes, and investors may incur additional fees such as front-end loads or back-end loads. On the other hand, ETFs are traded on exchanges throughout the trading day, allowing for more flexibility and control over the buying and selling process. This can result in lower trading costs for ETFs compared to mutual funds.

Liquidity and Trading

When it comes to trading and liquidity, mutual funds and ETFs have some key differences that investors need to be aware of.

Liquidity Difference

- Mutual funds are only traded at the end of the trading day at their net asset value (NAV), which means investors may not always get the exact price they see when they decide to buy or sell.

- On the other hand, ETFs trade on exchanges throughout the day at market prices, which means investors can buy or sell at any time during market hours at the current market price.

Trading Ease

- Trading mutual funds can be a bit more cumbersome because investors have to wait until the end of the trading day to execute their orders, and the price they receive is based on the NAV at that time.

- ETFs, being traded on exchanges, offer more flexibility as investors can buy or sell at any point during market hours, allowing for quicker execution of trades.

Trading Process and Frequency

- Mutual funds are bought and sold directly through the fund company or a broker, typically with a one-day settlement period. Investors can place orders anytime during the trading day, but the transactions are executed at the NAV at the end of the day.

- ETFs, on the other hand, are traded on stock exchanges like individual stocks, and investors can place market or limit orders throughout the trading day. This means more frequent trading opportunities and the ability to react quickly to market changes.

Tax Efficiency

When it comes to tax efficiency, ETFs have a clear edge over mutual funds. This is because of the differences in how they are structured and how they are traded.

Tax Implications of Investing in Mutual Funds

When you invest in a mutual fund, you may be subject to capital gains taxes even if you didn’t sell any of your shares. This is because mutual funds are required to distribute capital gains to their shareholders at the end of each year. These capital gains distributions are taxable, so even if you reinvest them, you still owe taxes on them.

ETFs are More Tax-Efficient

On the other hand, ETFs are structured in a way that makes them more tax-efficient. Since ETFs are traded on an exchange like stocks, investors only incur capital gains taxes when they sell their shares. This means that investors have more control over when they realize capital gains and can potentially defer taxes until they decide to sell.

Impact of Capital Gains Distributions

Capital gains distributions in mutual funds can have a negative impact on investors, especially if they are in a higher tax bracket. These distributions can lead to unexpected tax bills, even if the investor didn’t sell any shares. In contrast, ETF investors have more control over when they incur capital gains taxes, making them a more tax-efficient option for many investors.

Diversification and Risk

Investing in mutual funds and ETFs can provide investors with diversification, which means spreading out their investments across a variety of assets to reduce risk. Both mutual funds and ETFs typically consist of a collection of securities, such as stocks, bonds, or commodities, allowing investors to access a diversified portfolio without having to purchase individual assets.

Diversification Strategies

- Mutual Funds: Mutual funds are actively managed by professional portfolio managers who select and manage the fund’s holdings. These managers aim to diversify the fund’s investments across different sectors, industries, and asset classes to mitigate risk.

- ETFs: ETFs are passively managed and aim to replicate the performance of a specific index or asset class. By investing in an ETF, investors can achieve instant diversification as the fund holds a basket of securities that mirror the underlying index.

Risk Comparison

- Mutual Funds: The level of risk associated with mutual funds can vary depending on the fund’s investment objectives, holdings, and management style. Actively managed mutual funds may carry higher fees and potentially higher risk due to the active trading and management involved.

- ETFs: ETFs are generally considered to have lower expense ratios compared to mutual funds, which can translate to lower overall costs for investors. Additionally, since ETFs are passively managed, they tend to have lower turnover rates, reducing the potential for capital gains taxes and minimizing risk.